Riding the Shifting Winds of Life Sciences Funding to New Heights

Achieving strategic growth amid an evolving capital environment

Vikram Rajan

Send download link to:

Executive Summary

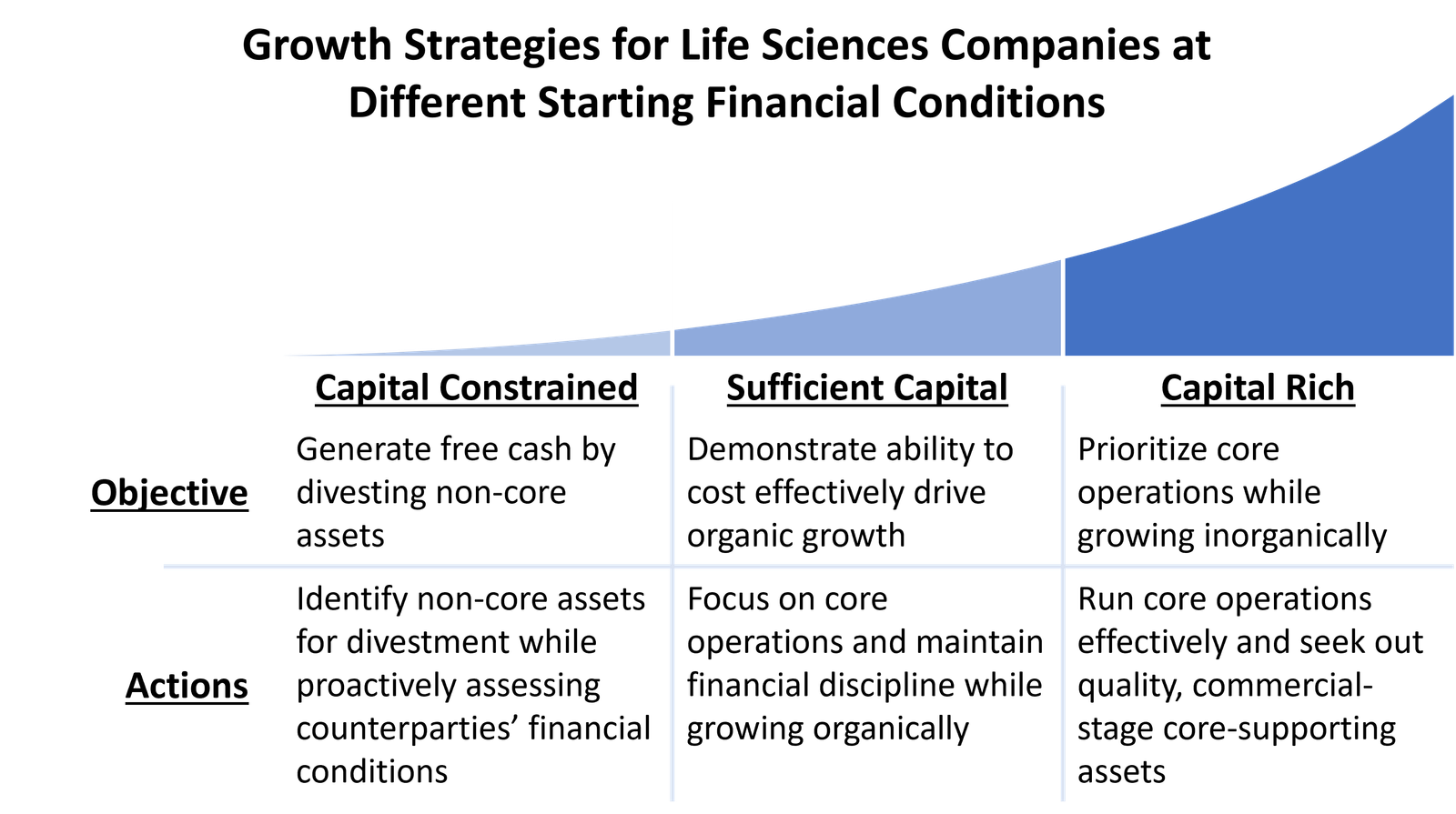

Many anticipate that capital will become increasingly available to companies across the U.S. economy in 2024, but the life sciences industry continues to lag the broader market. Life sciences executives need to demonstrate their prowess at capitalizing on organic and inorganic growth opportunities to unlock additional funding. In implementing growth strategies, leaders must account for their company’s current capital condition relative to the broader market’s.

In December of 2023, the Federal Open Market Committee (FOMC) painted a more optimistic picture for 2024 than many anticipated.[1] Chairman Powell indicated that the FOMC, responsible for managing the United States’ money supply to shape interest rates,[2] will not only stop raising interest rates in the immediate term but may decrease rates sometime in 2024.[3] Investors took note, and the Dow Jones Industrial Average closed at a record high of 37,090,[4] a 1.4% increase from the day before.[5]

XBI, a biotech exchange traded fund (ETF) that arguably reflects investor sentiment towards the life sciences industry, was even more bullish, with a one day jump of 4.8% following the FOMC news.[6] However, this increase is a small victory for life sciences companies after considering XBI’s underperformance since the heights of the pandemic. The ETF’s closing price after the FOMC announcement is almost unchanged from the same time the previous year[7] and 3/4 of what it was two years prior.[8] For comparison, the S&P 500 was up over 15% year-on-year.[9]

Although we are likely transitioning to an improving capital environment, capital distribution across industries and individual companies will be uneven.

Although the broader economy will likely see an average increase in available cash as a result of easing interest rates,[10] the distribution across industries[11] and individual companies will be unequal.[12] In particular, investors may continue to be more measured in deploying capital into life sciences companies in light of the industry’s post-pandemic underperformance. To unlock the capital available in the broader market, life sciences leaders must communicate the investment quality of their enterprise.[13]

Life sciences CEOs and business development teams need to demonstrate that they can generate cost effective growth.[14] The growth levers management pulls, in turn, depends on how accessible funds are to their specific company when they begin implementing these strategies. This paper details how life sciences executives should respond to an improving capital environment based on their current relative financial condition, characterized as sufficient capital, capital rich, or capital constrained.

Sufficient Capital Condition

A company in a financially stable condition should prioritize growing core operations organically. The optimal approach to organic growth will depend on the nature of the company’s core operations and the stage of development of its main value-driving assets. For example, a commercial-stage generics company has cash generating operations, so organic growth may mean stimulating sales (e.g., providing sales representatives with access to rich provider data) while cutting costs and overhead (e.g., streamlining manufacturing). Deploying capital prudently in this situation generates quick and meaningful returns. By avoiding the capital markets, leadership can use operations to effectively lower the company’s cost of capital.[15] In contrast, a clinical-stage biotechnology company must continuously seek outside funding to advance costly clinical trials. Organic growth at this stage could mean accelerating clinical development by saving on R&D time and costs, for example through insourcing and optimizing operations.[16]

In both cases, the value that is generated is less certain than the immediate costs that go into the pursuit. Companies led by financially disciplined CEOs and CFOs pursue initiatives where the probability-weighted potential value generated outweighs the more certain upfront costs. This financial discipline is critical not just for effective cash management – it also strengthens the organization’s negotiating position with outside parties when needed. In particular, having a strong organic growth option provides enormous leverage for licensing, partnerships, and M&A conversations, topics to be discussed below.

Capital Rich Condition

When capital is easily accessible, financial discipline remains critical. Beyond identifying initiatives with a positive net present value, leaders should ensure they do not pursue projects that generate less value relative to alternative uses. Financial discipline is a virtue that is rewarded by investors,[17] while the inverse can be severely punished. For example, consider public life sciences companies trading below their cash balances,[18] which at times reflect investors’ belief that management’s initiatives will cost more than they will make in return.

However, financial discipline does not mean abandoning the focus on organic growth. Ever improving business operations signal the quality of the company and the competency of its leadership to all parties. Investment bankers regularly remind clients to keep sufficient resources allocated to organic growth, even as they enter conversations with counterparties regarding M&A, licensing, and other partnership structures. The net value generated through these inorganic opportunities should be evaluated against the net value of organic initiatives. In this way, the process of evaluating external opportunities is an expansion of the prioritization of internal initiatives. This comparison is especially applicable in the current environment, where many life sciences companies are growing core operations inorganically through M&A.[19]

Inorganic growth comes to the forefront when capital is so easily available market-wide that investors demand growth faster than can feasibly be achieved organically.[20] Standard practice states that when the industry as a whole is capital rich, life sciences buyers should acquire a variety of early-stage assets[21] using equity as consideration.[22] However, in light of how pronounced and recent the post-pandemic market correction was in life sciences history, investors may demand revenue growth on a more accelerated and less risky timeline.

Under these conditions, life sciences business development executives should consider paying a premium for a high quality de-risked asset near or at commercialization. This action may be wise even relative to developing additional early-stage assets for future value capture, either organically sourced or acquired at a discount. The specifics of the approach depend on the business model, asset mix, competitive environment, and other factors, many of which, in turn, are also shaped by capital availability.

The process of evaluating external opportunities is an expansion of the prioritization of internal initiatives.

Capital Constrained Condition

Simply maintaining business operations in a capital constrained condition is a challenge. Management at all levels must ruthlessly prioritize every activity and initiative. Maintaining core business operations remains paramount, but what constitutes the core may shrink based on senior leadership’s assessment of which organic initiatives are most value generating.

However, when the broader market has a capital inflow, even the leaders of a capital constrained company can capture additional value. Analysts predict that in 2024, value generating transactions will be more commonplace,[23] increasing overall market value creation. Thus, an adept seller should still be able to find opportunities to grow their cash on hand in this environment, despite their weak individual financial condition.

In a life sciences context, value generating transactions typically mean selling an asset, out-licensing, or a partnership. Partnerships with well-resourced partners can support and fund core operations, even ignoring any exchange of consideration. However, the former two options may be effective ways to raise funds to continue running core operations on a standalone basis while still in a capital constrained condition.

Companies that have already deliberately and diligently streamlined their core operations should consider a sale or out-licensing to fund a transition to growing core operations organically. These financially disciplined companies can benefit from accepting cash payments with a lower headline number in lieu of potentially higher, yet inflated, equity consideration.

During these evaluations, leaders should seek to understand the financial condition of potential counterparties. Cash rich counterparties, for example, are more likely to pay larger upfront cash payments[24] and pay a premium.[25] Proactive diligencing is also valuable for transactions that share risk and reward, such as out-licensing and accepting equity consideration.[26]

The extreme end of the divestment spectrum is the outright sale of a company. This is particularly relevant to companies that cannot demonstrate the value of further developing their main assets through standalone operations. In this scenario, the consideration mix and premium is less significant to the operations but is still important to investors. The counterparty’s capital position, therefore, still matters.

Conclusion

As the capital environment evolves in 2024, life sciences leaders will have new opportunities to unlock increased funding. The key is to communicate the value of management’s organic and inorganic growth initiatives to investors and prospective counterparties. Precedent shows that financially disciplined executives and opportunistic business development teams can unearth value regardless of a company’s starting financial condition. However, access to capital is just the starting point for evaluating internal and external factors that shape the specific decisions a life sciences company should take. Life sciences leaders should use the principles covered in this paper along with the strategic application of financial and technical analyses to craft and implement effective growth plans.

Key Takeaways

- Investors in 2024 may be more willing to invest capital in the economy overall, but the distribution among industries and individual companies will not be even.

- To unlock funding, develop growth strategies that consider your company’s starting financial condition relative to the broader market’s.

- Starting company-specific financial conditions:

- Sufficient capital. Maintain financial discipline and prioritize core operations to drive organic growth.

- Capital rich. While focusing on core operations, further accelerate growth by acquiring quality, commercial-stage assets – which may also ease life sciences investors’ post-pandemic trepidation.

- Capital constrained. After prioritizing core operations, divest non-core assets. It is critical to understand a counterparty’s financial condition before advancing discussions on potential transactions.

About the Author

Vikram Rajan is Founder & Managing Partner at Stratospheric, a boutique consulting firm that offers a customized blend of strategy, finance, and intellectual property services for life sciences companies and other innovation-focused organizations. Vikram brings experience from Goldman Sachs as a healthcare investment banker where he advised C-suite clients to strategically transform their life sciences operations through M&A, partnerships, and financings. He worked at Deloitte as a management consultant, where he helped found and scale a consulting practice for digital manufacturing strategy and intellectual property management. Vikram earned an MBA and JD from Northwestern University’s Kellogg School of Management and Pritzker School of Law, and a BS and MSE in biomedical engineering from Johns Hopkins University.

[1] Darla Mercado. Full recap: Here are Fed Chair Powell’s market-moving comments as stocks rally on new rate outlook. CNBC. December 13, 2023. https://www.cnbc.com/2023/12/13/fed-meeting-today-live-updates-on-december-fed-rate-decision.html. December 30, 2023.

[2] Troy Segal. Federal Open Market Committee (FOMC): What It Is and Does. Investopedia. May 14, 2023. https://www.investopedia.com/terms/f/fomc.asp#:~:text=The%20Federal%20Open%20Market%20Committee%20(FOMC)%20is%20the%20division%20of,which%20impacts%20other%20interest%20rates. December 30, 2023.

[3] Darla Mercado.

[4] Dow ends at record high as Fed signals lower borrowing costs in 2024. Wall Street Journal. December 13, 2023. https://www.reuters.com/markets/us/futures-edge-higher-with-feds-final-verdict-year-tap-2023-12-13/. December 19, 2023.

[5] Close for DJI on December 12, 2023 was $ and on December 13, 2023 was $, an approximately 1.4% increase. Yahoo Finance. https://finance.yahoo.com/quote/%5EDJI/history/. January 8, 2023.

[6] Close for XBI on December 12, 2023 was $80.08 and on December 13, 2023 was $83.95, an approximately 4.8% increase. Yahoo Finance. https://finance.yahoo.com/quote/XBI/history?p=XBI December 19, 2023.

[7] Close for XBI on December 13, 2022 was $82.82 and on December 13, 2023 was $83.95, an approximately 1.4% increase. Yahoo Finance. https://finance.yahoo.com/quote/XBI/history?period1=1670889600&period2=1702512000&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

[8] Id. Close for XBI on December 13, 2021 was $110.78 and on December 13, 2023 was $83.95, an approximately 24.2% decrease.

[9] Close for S&P 500 on December 13, 2022 was 4,019.65 and on December 13, 2023 was 4,707.09, an approximately 17.1% increase. Yahoo Finance. https://finance.yahoo.com/quote/%5EGSPC/history?period1=1670803200&period2=1702512000&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true. January 16, 2024.

[10] How Does Money Supply Affect Interest Rates? Investopedia. June 28, 2021. https://www.investopedia.com/ask/answers/040715/how-does-money-supply-affect-interest-rates.asp. December 20, 2023.

[11] Greg Iacurci. The Fed is expected to cut interest rates in 2024. Here’s how investors can prepare. CNBC. https://www.cnbc.com/2024/01/03/the-fed-could-cut-interest-rates-in-2024-how-investors-can-prepare.html. January 9, 2024.

[12] GROWTH COMPANIES, ACCESS TO CAPITAL MARKETS AND CORPORATE GOVERNANCE: OECD REPORT TO G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS. OECD. September 2015. https://www.oecd.org/g20/topics/financing-for-investment/OECD-Growth-Companies-Access-to-Capital-Markets-and-Corporate-Governance.pdf

[13] Pam Yee, Matthew Waterbury, Whit Keuer, & Hubert Shen. Creating Value by Thinking Like an Investor. Bain & Company. May 31, 2023.

https://www.bain.com/insights/creating-value-by-thinking-like-an-investor-webinar/. December 27, 2023.

[14] Id.

[15] Aswath Damodaran. The Cost of Capital: The Swiss Army Knife of Finance. April 2016. https://pages.stern.nyu.edu/~adamodar/pdfiles/papers/costofcapital.pdf. December 26, 2023.

[16] See Formation Bio as an example of this business model. https://www.formation.bio/. January 18, 2023.

[17] Pam Yee, et al.

[18] Navigating the Complex Terrain: Healthcare and Biotech Markets in Q3 2023. Leerink Partners. September 29, 2023. https://www.leerink.com/articles/navigating-the-complex-terrain-healthcare-and-biotech-markets-in-q3-2023/. December 26, 2023.

[19] Priya Shah. M&A Industry Trends & Outlook 2024. DFIN. December 13, 2023. https://www.dfinsolutions.com/knowledge-hub/thought-leadership/knowledge-resources/m-and-a-industry-trends. December 28, 2023.

[20] Michael Mankins, Karen Harris, & David Harding. Strategy in the Age of Superabundant Capital. Harvard Business Review. March 2017 https://hbr.org/2017/03/strategy-in-the-age-of-superabundant-capital. December 26, 2023.

[21] Id.

[22] Vartika Gupta, David Kohn, Tim Koller, & Werner Rehm. Prime Numbers: How you finance M&A won’t affect overall value creation. McKinsey & Company. March 9, 2023. https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-strategy-and-corporate-finance-blog/how-you-finance-m-and-a-wont-affect-overall-value-creation. December 22, 2023.

[23] Priya Shah.

[24] Francesco Baldi & Antonio Salvi. Disentangling acquisition premia: Evidence from the global market for corporate control. Finance Research Letters. Volume 48. August 2022.

[25] 1) Alfred Rappaport & Mark L. Sirower. Stock or Cash?: The Trade-Offs for Buyersand sellers in Mergers and Acquisitions. Harvard Business Review. December 1999. https://hbr.org/1999/11/stock-or-cash-the-trade-offs-for-buyers-and-sellers-in-mergers-and-acquisitions. December 22, 2023.

2) Dan Doran. Why Excess Cash Impedes Your Growth. Quantive. May 1, 2023. https://goquantive.com/blog/why-excess-cash-impedes-your-growth/. December 22, 2023.

[26] Id.

2 Responses

Wow Thanks for this content i find it hard to stumble on smart data out there when it comes to this content appreciate for the article website

This article offers a fascinating perspective on the subject. The depth of research and clarity in presentation make it a valuable read for anyone interested in this topic. It’s refreshing to see such well-articulated insights that not only inform but also provoke thoughtful discussion. I particularly appreciated the way the author connected various aspects to provide a comprehensive understanding. It’s clear that a lot of effort went into compiling this piece, and it certainly pays off. Looking forward to reading more from this author and hearing other readers’ thoughts. Keep up the excellent work!